Using one of the best personal finance management apps are great for those who need to take control of their money and improve financial habits.

You will get to know the 7 best personal finance management apps available, with options for different profiles, from those who prefer simplicity to those looking for complete resources for budgeting, goals and daily control of expenses.

Today you will learn a complete analysis of the best personal finance management apps, with advantages, limitations and differentials of each one. Read on to find out which app suits you best.

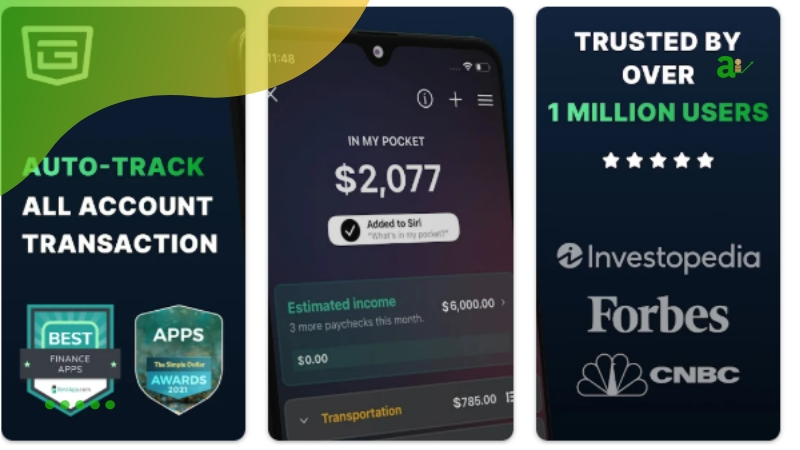

1. PocketGuard (Best Personal Finance Management Apps)

If you want a simple and straightforward way to track your spending, PocketGuard is an option to consider.

With a simple interface, the app shows you how much money you have available, how much goes to bills, and how much is left to spend. All in real time.

You can also view your expenses in a personalized graph, which makes it much easier to control.

Above all, the difference is that you can choose the budgeting method that best suits your style. Therefore, you can put together a plan that really works in your daily life.

The downside is the website, which is not as user-friendly, and it also doesn’t have a free version.

2. Quicken Simplifi

On the other hand, if you are looking for a complete way to take care of your household finances, Quicken Simplifi is an alternative that you should consider.

In addition, you can control accounts, track your goals, monitor cash flow, and even share the budget with your partner.

At first, the app brings everything together in one place. Being able to import your transactions from other databases.

In addition to being able to receive real-time alerts about unusual expenses or bills that are due. In addition, you can create personalized goals to save money.

On the other hand, there is no free trial, and the subscription prices are high.

3. EveryDollar (Best Personal Finance Management Apps)

First of all, EveryDollar is suitable for those looking to have everything in just one place.

Based on the zero-based budgeting method, the app helps you give a clear destination for every penny of what you earn.

The interface is simple and intuitive, and you can customize the budget categories the way you prefer.

Using the free version you can start organizing your financial life, and anyone who wants to test everything the app offers just use the platinum subscription.

However, not everything is an advantage, without the signature, you will need to register the information manually, which can take a long time. In the paid plan, transactions are imported automatically, which makes everything more practical.

4. CountAbout

Whether you’re self-employed or self-employed. CountAbout can be the ideal tool for uniting personal and professional finances in one place. The app combines budgeting, accounting, and invoice issuance features, which makes it much easier to organize your day-to-day finance.

One of the great differentials is the possibility of capturing receipts and creating invoices directly through the platform — something rare among budget apps. You can also customize reports and create tailored budgets, all with a focus on those who need practicality in financial management.

The 45-day free trial is one of the most generous on the market, but it’s worth noting that there isn’t a completely free version. On the Standard plan, transactions need to be imported manually. Which can be a bit of a hassle at first. In the Premium plan, there is automatic synchronization with banks and cards.

CountAbout is ideal for independent professionals who want to keep track of everything in one place, from personal expenses to business cash flow. It delivers a simple, complete, and to-the-point experience — even if you need a little time to get used to the navigation.

5. Fudget

Fudget, unlike many apps full of functions, seeks to facilitate the control of entrances and exits in a simple way.

No confusing charts or automatic categories is almost like keeping a digital notebook. You can also customize the currency symbol and language, which makes everything more accessible.

However, simplicity comes at a price. The app does not synchronize with bank accounts, does not track your assets and most of the features are only available in the paid version.

Still, it has a free version and a seven-day trial for those who want to try the full version.

6. YNAB (Best Personal Finance Management Apps)

If the idea is to take full control of your finances and give a specific destination to each penny that comes in, YNAB can be your great ally. The focus here is to make realistic planning with the money you already have. Helping you avoid debt and organize yourself more consciously.

The app allows you to customize goals, track progress with detailed reports, and adjust the budget as your priorities change. And if any questions arise, support is one of the strengths: you can find practical guides, answer questions live, and you can even participate in free workshops to learn how to use the app in the best way.

On the other hand, it is worth noting that YNAB only allows you to plan with the money that is already in the account that is, you cannot organize the budget by counting on the next salary, for example. In addition, it does not track investments and the interface is very reminiscent of a spreadsheet which may not please everyone.

Still, YNAB is ideal for those who want to be proactive with their own money and organize each paycheck with strategy. A powerful tool for those looking to turn the budget into a true action plan.

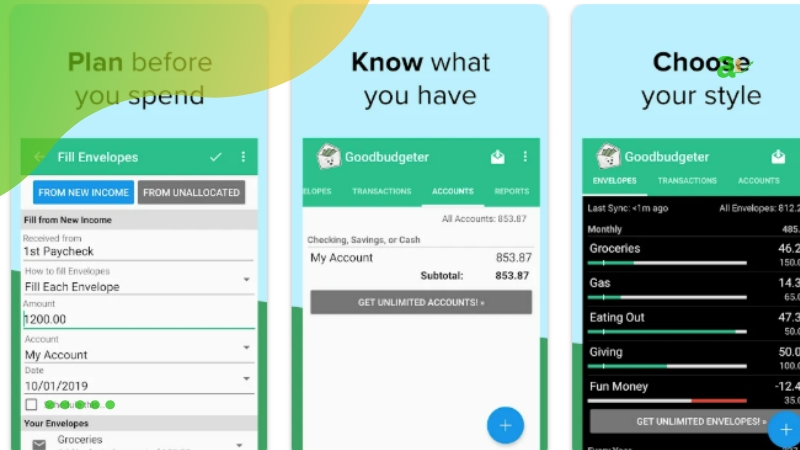

7. Goodbudget

At first, Goodbudget distributes your money in virtual envelopes, categorizing expenses. For example, rent, market, transportation and sets a limit for each one

What stands out about Goodbudget is that you can use the app as a family or with your partner. You can synchronize the household budget with more than one person, making it easier to control finances together.

Additionally, you need to enter all transactions manually as the app does not connect to bank accounts.

However, there is a downside for those who prefer to automate everything. In addition, it does not display a complete picture of your finances in one place.

Conclusion (Best Personal Finance Management Apps)

Now know all the best personal finance management apps. In this way, it is clear that there are options for all profiles.

If you need something more straightforward, Fudget or Goodbudget may be ideal. Detailed planning is already sought, YNAB or Quicken Simplifi has more features.

Therefore, before choosing, think about your lifestyle, your financial goals. How much you want to be involved with planning. Using the right app, organizing your finances will become easy. In this way, you will be able to improve your condition and improve your score.