For those striving to enhance their credit scores, Credit Strong provides a valuable solution. Many with poor credit understand the challenges that come with it, including the arduous process of obtaining a credit card unless accompanied by hefty fees or security deposits.

Many individuals seek various means to elevate their credit ratings. From secured cards recognized by all three American credit bureaus to loans aiding debt payment, all options are on the table. However, a significant hurdle arises: loans or cards procured in this manner typically come with exorbitant interest rates, potentially exacerbating the situation.

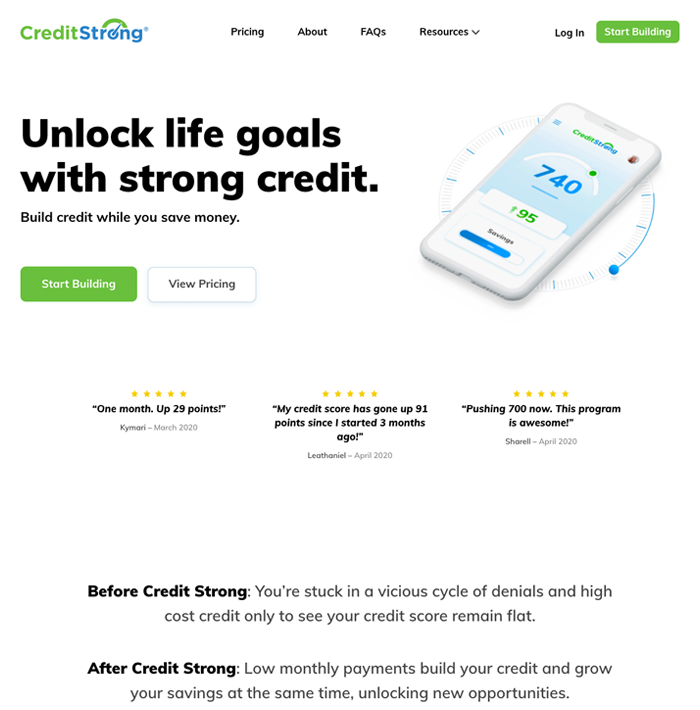

When a subpar score complicates financial wellness, what’s the solution? Enter Credit Strong, offering a unique proposition to steer you back to fiscal health. This platform permits users to maintain a kind of loan without the conventional approval process. Confused? Read on for a clearer understanding of this offering aimed at those with struggling credit scores.

What Exactly is Credit Strong?

In essence, Credit Strong operates somewhat like a loan. However, when you register, you don’t receive funds immediately. Instead, you gain access to a credit line that bolsters your credit rating. And with the backing of Austin Capital Bank, security concerns are minimized.

Credit Strong furnishes a secured loan, enabling users to establish a commendable payment history and an improved debt ratio. This positively affects one’s score, which will be elaborated upon shortly.

As users navigate the murky waters of debt and unfavorable scores with Credit Strong, monthly payments are reported to American bureaus. By the loan’s end, users should witness a notable uptick in scores, providing access to enhanced financial tools, like no-fee credit cards.

Understanding Credit Building Loans

Did you know that 35% of your credit score derives from your payment history, while another 30% considers current credit card and loan debts? Hence, securing a credit line is pivotal. It allows for the construction of a positive payment track record and better management of outstanding debt.

To simplify, when joining Credit Strong, you obtain a loan, but the funds are deposited into a savings account. Users then make payments, gradually boosting their credit history. Upon completion, the loan amount becomes accessible, and overall scores improve.

Even though loan interest is a factor, the savings account compensates as it too accrues interest. There are multiple Credit Strong loan products, each detailed further below.

This mechanism resembles a secured loan, prepping you for a brighter financial future. Note: Credit Strong isn’t akin to credit repair services. Instead of identifying report issues, it furnishes tools to craft an enhanced credit history.

Credit Strong’s Offerings

Credit Strong provides an array of products tailored for individuals and businesses, each with distinct pricing and fee structures. Hence, a comprehensive understanding, possibly with the assistance of company support, is advisable.

- Instal: This account communicates with all major US credit bureaus. Users determine their monthly payment, fostering credit score growth, and even simultaneous saving. A bonus? Monthly FICO score checks are free, aiding in tracking progress. Essentially, this is installment credit. Upon signing up for Instal, users decide its duration, with a cancelation option always available without extra charges. Two fee models exist: $15/month for a $1,000 account or $30/month for a $2,500 account, each lasting 120 months.

- Magnum: This installment account caters to larger amounts. When significant savings have been accumulated but a subpar credit score restricts favorable loan conditions, Magnum fills the gap, offering up to $10,000. Magnum bypasses credit checks, offers quick approvals, and is suitable for those aiming for attractive personal loans, high-limit reward credit cards, or needing a robust score for small business endeavors. Fees are straightforward: $55/month for a $5,000 account or $110/month for a $10,000 account, both spanning 120 months.

Is Credit Strong akin to a Savings Account?

Though resembling a savings account, Credit Strong differs since funds aren’t immediately accessible. However, interest accrual ensures the loan’s value remains intact over the 120-month payment period. Rather than viewing it as traditional savings, consider it a unique loan, enhancing your credit mix and payment history.

How Swiftly Can Credit Strong Boost Scores?

While Credit Strong aids score enhancement, it isn’t instantaneously effective. The timeline hinges on the depth of one’s credit issues, outstanding debts, and existing payment history. Novices in the credit realm might need six months to notice changes. However, minor increases could be seen sooner after consistent, timely payments.

No credit solution is swift or foolproof. Patience, punctual payments, and managing other outstanding debts are paramount. For immediate score enhancement, secured credit cards reporting to all bureaus might be apt. Yet, punctual monthly balance payments are crucial, as are those to Credit Strong.

Is Credit Strong Worth It?

Before enlisting Credit Strong, it’s essential to understand its costs, including monthly installments and various fees. Despite interest rates being more favorable than some credit cards designed for low scores, the costs can add up.

Credit Strong’s primary allure is its swift and straightforward approval, coupled with user-friendly management. Plus, users can opt-out anytime, reclaiming their saved money. This service is ideal for those seeking a comprehensive approach to credit rehabilitation. If immediate cash or a brief waiting period is more appealing, other loan services might be more suitable.

Does Credit Strong Impact Your Score Negatively?

Upon application, Credit Strong exerts no influence on your score, given the absence of a hard credit check. Therefore, users can proceed confidently, knowing this service solely offers potential score improvement in subsequent months.